As we move forward into our future, we are humbled to look back at our company’s history. We celebrate the milestones reached since 1964 and greatly appreciate the contributions from our producers, associates and companies over the years.

Thank you for being part of the Arlington/Roe family, for we are truly a family business, both literally and figuratively. We hope you enjoy this review of key points in the life and history of our company. We’d love to hear memories from those of you who have traveled with us. We are proud of what we have accomplished and excited about the future. Thank you for your partnership and friendship.

Sincerely,

Our Timeline

In 1952, he moved his family to Indianapolis to run the Baker Shoe store on Washington Street.

Francis was the second oldest of seven children. Francis’ older brother, Norman, pursued a career in finance and ultimately found his life-long work as a senior executive with Foremost Insurance Co. A primary product at Foremost was mobile home insurance.

One day, Norman asked his brother Francis to travel with him. Seeing potential in the business of insurance, Francis left the security of women’s shoe sales for a life-changing career in insurance and a cut in pay.

From 1955 to 1964, Francis worked as a field underwriter for Meridian Insurance, State Auto Insurance and then again for Meridian Insurance. When calling on agents, Francis was often asked if he could insure mobile homes, referred to today as manufactured homes. At that time, mobile home insurance was packaged with the purchase loan and normally written through the mobile home dealer or bank.

Francis Roe approached Orville Allen, president of State Auto Insurance, and Carl Russell, president of Meridian Insurance, about offering mobile home coverage to independent insurance agents to sell directly to mobile homeowners. Both Mr. Allen and Mr. Russell declined.

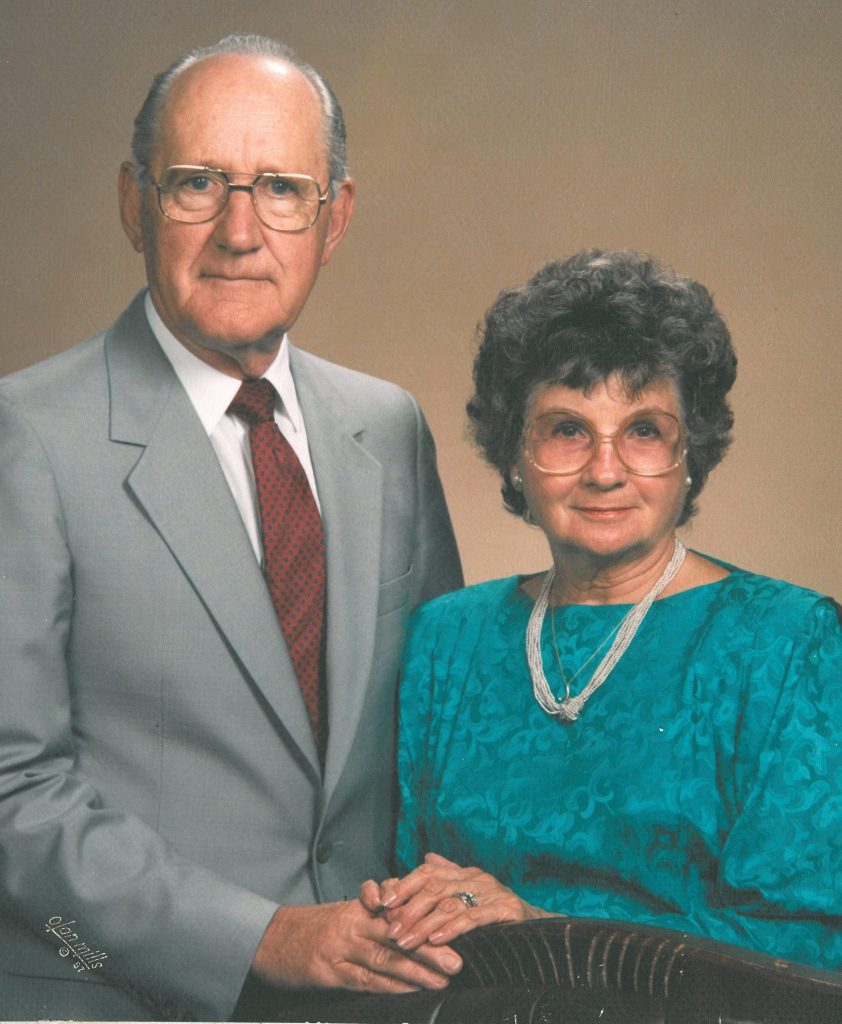

Shortly after these declinations, Francis received a $25.00 a month raise and he quit, telling his employer, “you must need the money more than I do.” His next bold statement was to Ruth, his wife and mother of five, “Ruth, I just quit my job.”

Norman Roe didn’t see much opportunity in bypassing the dealer to insure mobile homes, but he gave Francis Roe a contract, and Arlington Insurance Agency was formed on August 13, 1964. At the age of 41, Francis set up shop in the family kitchen and together with Ruth made ends meet. They had five children, a 1949 DeSoto and literally budgeted by putting money in envelopes for gas, food, the mortgage and basic needs. They were on a mission together to build a family-owned business.

Francis bought a small desk big enough to hold a typewriter, used the kitchen table during the day to spread out work and the phone on the wall was equipped with an extra-long cord. Their telephone service was by way of a “party-line” where multiple people shared the same phone line, and their mailing address was 5024 N. Kitley in Indianapolis, Indiana, six blocks away from Arlington High School.

In fact, the name “Arlington” originated from Francis Roe’s dream to move to one of the offices next to the Devington Shopping Center on Arlington Avenue once his business was big enough. Though the company never moved to those offices, in 1980, Jim Roe proposed adding “/Roe” to end to emphasize the importance of family.

Jim Roe entered the business as a teenager typing policies for his father. Minimum premiums were $15 and commissions ranged from 35% to 40%. Jim earned 25 cents per hour. Francis thought Jim was being overpaid.

Francis secured a contract with Western Fire and Casualty out of Ft. Scott, Kansas, which became American States and then Liberty, and he wrote about $40,000 in small commercial business. Arlington Insurance Agency was growing, and the family went on vacation.

In addition to the normal things families pack for vacation, Francis packed a metal box that contained the Rough Notes insurance accounts receivable records so important to his business.

He left the agency to work on the company and agency side with Hartford Insurance Co. as a western Kentucky marketing representative, then an independent agent with the Charles Moore Agency in Bowling Green, Kentucky.

In 1980, Jim rejoined his father and they changed the family business name to Arlington/Roe & Co. Francis and Jim got busy growing the business. They joined the Big “I,” PIA, 1752 Club and Blue Goose.

Jim earned his CPCU designation. They joined NAPSLO in 1981 and AAMGA in 1983. They became a family-owned business on the move.

As referenced in 1964, the company changed its name from Arlington Insurance Agency to the same one it has today, “Arlington/Roe.”

Arlington/Roe moved to Shorewood Drive just east of 56th and Keystone.

Jim Roe worked with Hugh McGowan, Sr. in writing the Pan American Games held in 1987. The market was hard, and the agency did not have all the players or the markets to take full advantage of the marketplace.

Arlington/Roe would make major associate and market advancements in the years to follow.

In 1989, the company celebrated its 25th anniversary. Jim had been highly encouraged to give the company a logo. He then stated he would pay $100 to anyone who could come up with a logo that he liked and suited Arlington/Roe.

A young staff member, who was an amateur artist, took up the challenge and designed the company’s first logo of a blue AR with a gray ribbon in between the letters. The blue stands for strength and stability and the gray stands for the company’s flexibility and adaptation as the insurance industry is hardly ever black or white.

As a member of the National Association of Professional Surplus Lines Offices (NAPSLO) board of directors, Jim expanded his involvement in the industry from regional to national.

Arlington/Roe moved to 8465 Keystone Crossing. An aviation insurance office was established in Louisville, Kentucky. Vickie Roe, Jim’s wife, joined the agency.

Jim’s service to NAPSLO marked the beginning of his dedication to affect change in the industry at a national level. Aviation grew as a national product for Arlington/Roe. Over the next few years, the Louisville office grew into a full commercial underwriting office.

The longstanding relationship with Foremost was moved to American Modern Insurance Group. Jim Roe served as president of the American Association of Managing General Agents, AAMGA.

Arlington/Roe moved to its current home office at 8900 Keystone Crossing in Indianapolis and opened an underwriting office in Geneva, Illinois, purchased Cooling Grumme & Mumford from Indiana Insurance Company, and, in Grand Rapids, Michigan, purchased Witters & Klap.

Andy Roe first and then Patrick Roe, two of Jim’s sons, joined the family-owned agency in the next few years.

Andy Roe joined Arlington/Roe as the first member of the third-generation of the Roe family. Three years after joining the company, he spent some time in his early insurance career interning for an Excess & Surplus Lines company in Arizona and in London with Lloyds.

After Lloyds of London, Andy returned to Arlington/Roe, where he lead the commercial underwriting division.

Following in the footsteps of grandfather, Francis “Leo,” and father, Jim, Patrick joined his brother Andy at Arlington/Roe as the second member of the third generation of the Roe family.

He first began working as a Personal Lines Assistant Underwriter and Underwriter. After five years, he transitioned to a Personal Lines Marketing Representative before moving to Marketing.

Arlington/Roe purchased Southern General Agency in Bowling Green, Kentucky, purchased Agents Advantage Network in Nashville, Tennessee, opened an underwriting office in Grand Rapids, Michigan, and hired the first Ohio associate.

Each location came to be because of the talent Jim Roe saw in people who lived there.

Arlington/Roe was on the move again after the softening of the market due to the financial crisis.

Andy Roe was named Executive Vice President of Commercial Lines and Brokerage. Patrick Roe became Vice President and Director of Marketing.

Arlington/Roe purchased Mid-South Insurance in Tennessee establishing roots for its next underwriting office location in Nashville. Additional Ohio insurance talent was secured, and plans were underway for an office in Columbus in 2014.

The Minnesota Big “I” appointed Arlington/Roe as their insurance manager for their membership E&O program. The National Big “I” also endorsed Arlington/Roe’s exclusive data breach and cyber liability program for Big “I” members.

Arlington/Roe had the opportunity to secure talented individuals in both Wisconsin and Minnesota, making those states the next emphasis on expansion. Additionally, the company took over an Ohio book transfer from Morstan General Agency.

Katie Roe Weiper became the third of Jim and Vickie Roe’s four children to work at the company, joining her brothers, Andy and Patrick. Christopher Roe pursued his acting career in Chicago and New York theaters and now lives in Uruguay as an entrepreneurial coach.

In celebration of the company’s 50th anniversary, the emphasis was placed on giving back. The number of philanthropic efforts were expanded.

An annual insurance internship was funded and launched by Arlington/Roe. Dollars and time were devoted to university insurance education programs and to a great number of state and local insurance associations.

Signaling another monumental advancement, Arlington/Roe hit record growth and broke the $200-million barrier.

As premium grew, so did the number of associates and office locations. The company hired over 20 people that year to keep up with its continued growth and opened an underwriting office in Minneapolis, Minnesota. Additionally, plans were underway for an office in Springfield, Missouri in 2015. Arlington/Roe also took over the Workers’ Compensation book of business for the Minnesota Big “I.”

Recognizing its own internal needs, Arlington/Roe implemented a new agency management system called ALIS. The new management system better suited the company’s data and production needs and streamlined processes for associates.

Patrick Roe received the Insurance Professional of the Year Award from the Independent Insurance Agents of Indiana. The award is given to an individual from an IIAI associate member organization who demonstrates strong leadership abilities with a willingness to assist independent agents, regularly supports the IIAI and fosters strong professional relationships with agents. Both Patrick and Andy have been very involved with the IIAI and are both past chairmen of the Indiana Big “I” Young Agents Committee.

Arlington/Roe continued its growth by purchasing several agencies. The company purchased Indiana Surplus Lines, Central Insurex in Ohio, and Envision Insurance Agency’s aviation book of business in Illinois.

The company also acquired Robert W. Schmidt, a special-risk broker in Brookfield, Wisconsin. The purchase allowed the company to add a state office in the greater Milwaukee area and effectively doubled the Wisconsin staff. The acquisition brought expanded access to Wisconsin independent agents.

In March, Arlington/Roe quickly formulated a response plan to the developing coronavirus pandemic. The company moved to a virtual work environment, with nearly all 187 associates in all offices working from home. The transition was quick and smooth, and there were little to no interruptions in how associates conducted business.

Patrick Roe was promoted to Senior Vice President, Marketing & Sales. Arlington/Roe ended the year with a new premium milestone of $213.7 million and 190 associates.

Arlington/Roe saw another year of monumental advancement. The company reached a new milestone of $250 million in premium.

Arlington/Roe also purchased Muench Insurance, a wholesale independent insurance broker located in Omaha, Nebraska. The acquisition brought expanded access to Nebraska and Iowa independent agents.

After over 20 years in the 8900 building at Keystone at the Crossing, Arlington/Roe moved just across the street to the 8888 building. The new office space was renovated, modernized and has several features to accommodate the company’s growing needs.

Andy Roe was promoted to Executive Vice President & Chief Operating Officer. Arlington/Roe continued its growth by purchasing the farm business of Premier Ag Partners, a broker in Flanagan, IL. This purchase gave the company greater access to farm markets and expanded authority with carriers. Arlington/Roe also reached a new premium milestone of $288 million and ended the year with 209 associates. The company has a goal of reaching $322 million in premium in 2023.

Arlington/Roe won two major awards. The company is the recipient of the 2022 National PIA Managing General Agent of the year award and the 2022 Big I of Indiana Company of the Year award.

Arlington/Roe experienced a remarkable year marked by significant milestones and continued success. The company achieved record growth, reaching $340 million in premium, highlighting its ongoing success trajectory.

Arlington/Roe received the Spirit United Award from the United Way of Central Indiana, acknowledging the company’s commitment to generosity and service. The annual award recognizes financial contributions and the efforts of associates who volunteer their time, advocate for causes and embody values of compassion and empathy.